indiana inheritance tax exemptions

Each heir or beneficiary of a decedents estate is divided into. IC 6-41-3-65 Annuity payments Sec.

Indiana Inheritance Laws What You Should Know Smartasset

The amount of each beneficiarys exemption is.

. How much money can you inherit without paying inheritance tax. Allowable exemptions are unlimited for Decedents surviving spouse and for qualified charitable entities. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts.

For individuals dying after December 31 2012. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Repeal of Inheritance Tax PL.

No inheritance tax returns Form IH-6 for Indiana residents and. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. Transfers to a spouse are completely.

Ad Information You and Your Lawyer Could Use for a Solid Estate Plan. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. No tax has to be paid.

The inheritance tax rates are listed in the following tables. 205 2013 Indianas inheritance tax was repealed. Class C beneficiaries includes all beneficiaries who.

The first inheritance tax law of indiana was passed in 1913. Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library. Indiana Inheritance Tax Exemptions and Rates.

Download Or Email Form ST-105 More Fillable Forms Register and Subscribe Now. Get an Estate Planning Checklist More to Get the Information You Need. The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as part.

Inheritance tax was repealed for individuals dying after Dec. For individuals dying after December 31 2012. Indianas inheritance tax was repealed for individuals dying after Dec.

This exemption was not changed by SEA 293. Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

Class A Net Taxable Value of Property. The item Inheritance tax. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

Up to 25 cash back They do not owe inheritance tax unless they inherit more than 500. Code 6-41-3-10 through 6-41-3-12 for specific exemption. Get an Estate Planning Checklist More to Get the Information You Need.

Repeal of Inheritance Tax PL. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be. Ie the total value of interest minus the applicable exemption by the appropriate tax rate.

Class B beneficiaries are given a 500 exemption before any tax is due. 205 2013 Indianas inheritance tax was repealed. But just because the inheritance taxes didnt change in.

In addition no Consents to Transfer Form IH-14. The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million. No inheritance tax returns Form IH-6 for.

If you have additional questions or concerns about estate planning and taxes contact an experienced. Indiana state income tax rate is 323. However that phase out was accelerated dramatically when the Indiana.

No inheritance tax returns Form IH-6 for Indiana. For more information please join us for an upcoming FREE seminar.

Pdf Inheritance Tax Regimes A Comparison

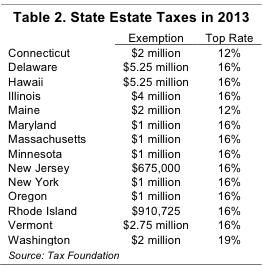

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

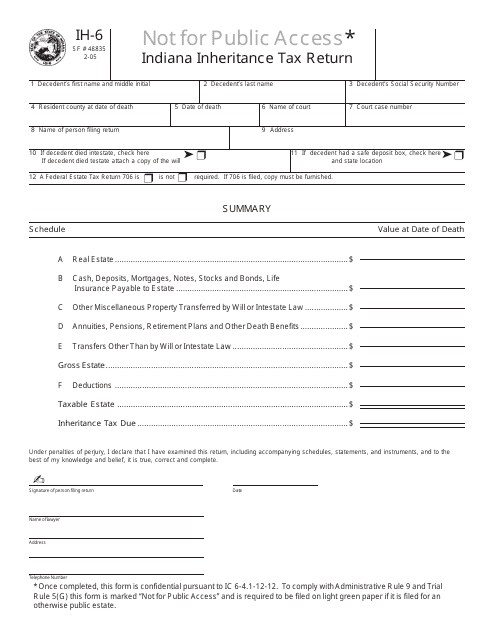

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

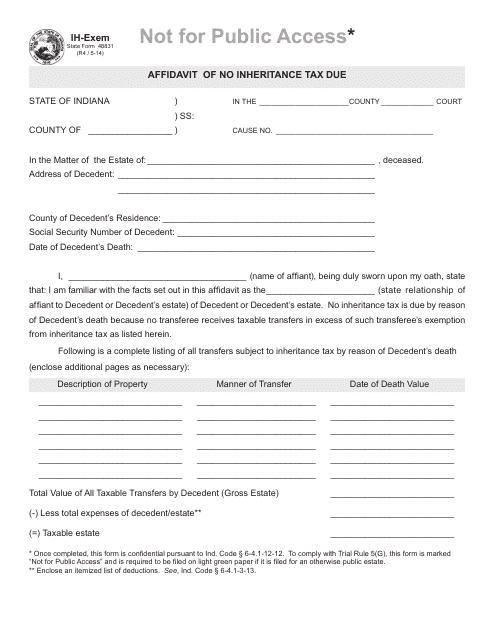

State Form 48831 Ih Exem Download Fillable Pdf Or Fill Online Affidavit Of No Inheritance Tax Due Indiana Templateroller

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

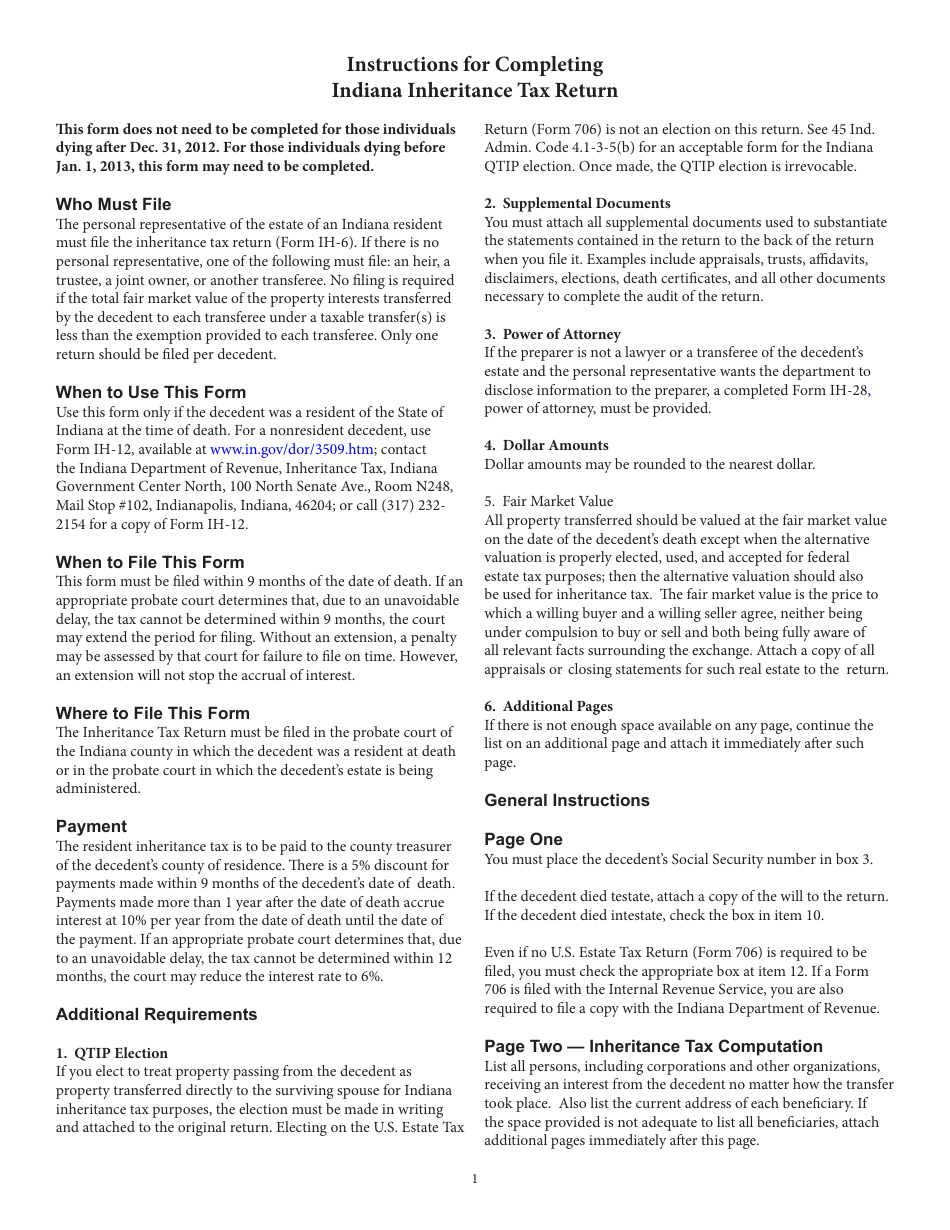

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

State Estate And Inheritance Taxes

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Fillable Online Ih 6 Not For Public Access Indiana Inheritance Tax Return Fax Email Print Pdffiller

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

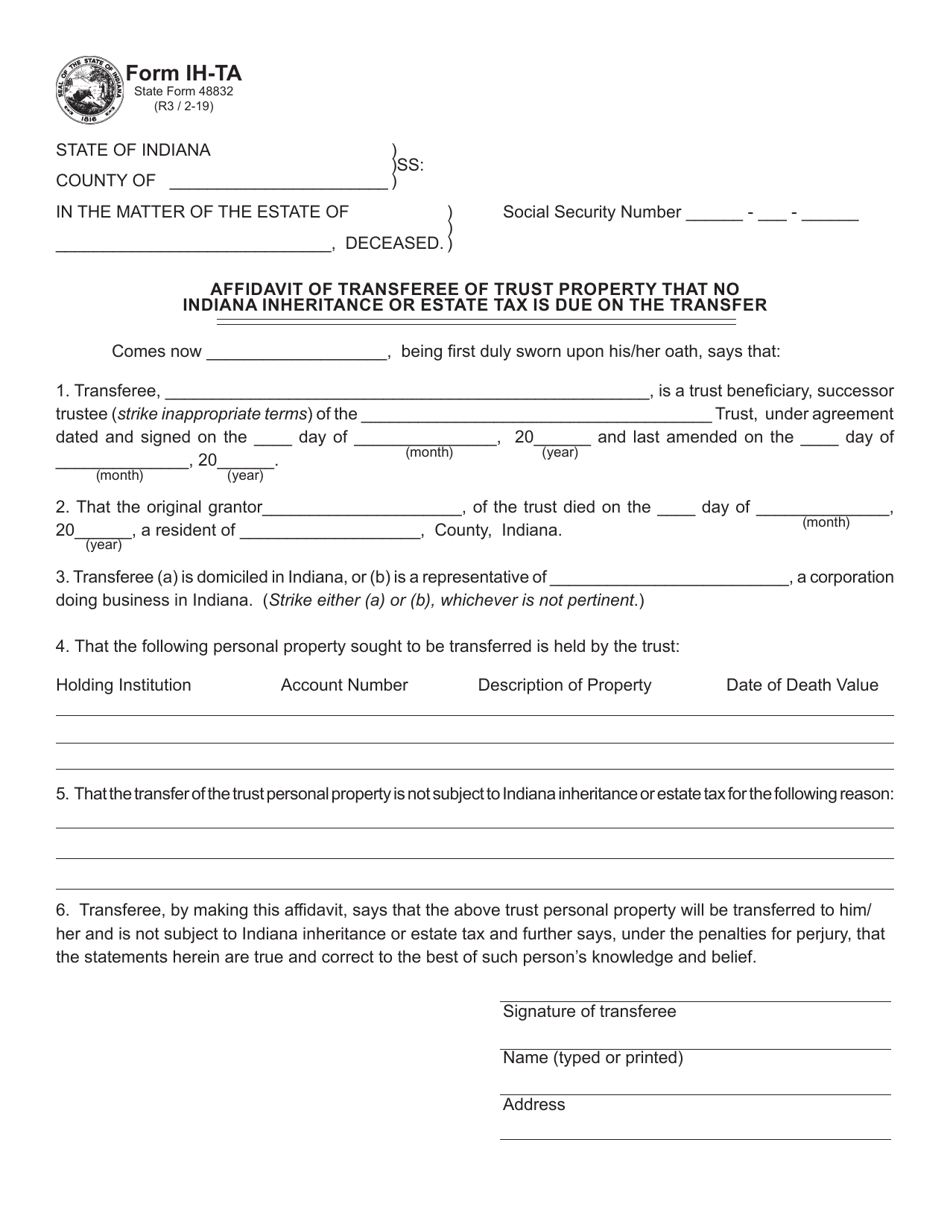

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

State Estate And Inheritance Taxes Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center